by Grant Glessing, RPF

Timber and timberland have traditionally been investment vehicles for institutional investors because of the amount of capital required. There are however, excellent opportunities in today´s timber and timberland investment marketplace for small retail investors. These investments provide individuals with the benefits of a diversified portfolio, as well as opportunities to invest in some of the higher yield precious woods that may be too small and specialized for large institutional investors. In this article I will address some of the most frequently asked questions about timber and timberland investments and describe the benefits these investments offer individual investors.

Return on Investment: Timber has outperformed all major stock markets over the past 25 years with an average annual return of 15% as measured by the National Council of Real Estate Investment Fiduciaries (NCREIF). The timberland index ranks timber first in growth, as $100 invested in timber in January 1987 would have grown to $2,190 by December 2008.

Inflation Protection: Timberland has historically provided good protection in times of inflation. It is widely recognized as one of the best ways to protect wealth in times of economic turbulence.

Uncorrelated to Other Assets: Timberland investments tend to move counter-cyclically with stocks and bonds. This allows the investor to offset risk while at the same time providing portfolio diversification, especially during times of extreme market volatility.

Environmental Benefits: Responsibly managed timberland is a green investment, providing many environmental benefits such as carbon sequestration, watershed protection, and animal habitat for the socially responsible investor.

Physical Risks – Although catastrophic events such as fire, pest infestations, and violent storms often get a great deal of media coverage, they actually account for a very low percentage of timberland losses. As with any investment vehicle individual investors should understand the physical risks and uncertainties associated with the particular timberland investments they are considering.

Liquidity – Timber is not an investment to be flipped for a quick return. It is best suited for the focused long-term investors who does not need ready access to their capital.

As the population of the world increases so does the demand for environmentally friendly wood products. According to the United Nations, world population is currently growing by approximately 74 million people per year and is expected to reach 9.2 billion by 2050. This unprecedented growth is occurring at a time when countries are enacting new conservation measures such as the REDD initiative to protect their forests. These factors alone will create long-term supply deficits for timber.

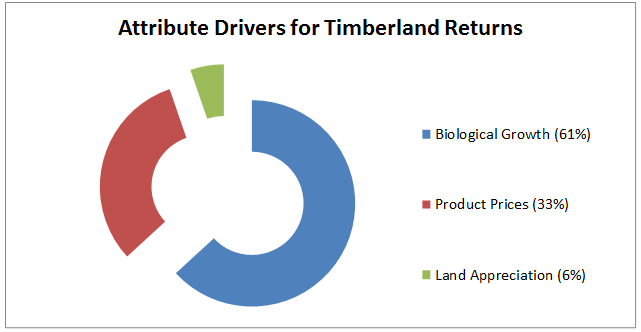

In a survey conducted at the University of Georgia Warnell School of Forestry Resources, it was demonstrated that the performance indicators that have traditionally driven timberland returns are biological growth, timber product prices, and land values. The chart below shows the significance of each of these attributes in a typical timber investment.

The most significant driver for timberland appreciation has been biological growth. Wood volume increases during each growing season increasing the value of the timberland even if product prices remain constant. Contrast this with gold, where one ounce is still one once year after year.

Prices at harvest time are critical to the performance of commodity investments. An advantage with timber investments is that harvests can be scheduled to occur in periods of economic expansion rather than contraction. Land appreciation has not traditionally factored highly into significant returns for timberland; however, appreciation has allowed some timberland companies to sell off some of their land at a significant profit for development purposes. These lands are often called HBU (Higher Better Use) land.

It has been estimated that the global carbon credit market was worth 126 billion dollars at the end of 2008. It is expected that over the next several years the United States will lay the ground rules for a cap and trade system. Although these market continues to hold great promise, the biggest issue facing timberland has been tied with the permanence of the carbon offset. Many academics continue to debate how long the carbon is actually stored and the risks involved with premature release from fire, pests, and disease.

Recently, New Zealand introduced its own emissions trading scheme (NZ ETS) that allows timberland owners to receive carbon credits. Part of the risk for these owners will be the requirement to purchase back carbon credits when they harvest their forest. If carbon prices are significantly higher at the time of harvest investor returns may be negatively impacted. Therefore, given these uncertainties it remains to be seen how lucrative carbon credits will become.

This depends on your investing timeframe as well as the level of risk you are willing to accept. Teak is one of the best investment species as it predominantly grows within 10 degrees latitude of the equator. Looking at a world map you will find very few countries with the right climatic conditions to grow teak well and even fewer countries that are stable enough for a long term investment. These attributes along with the unique characteristics of teak have put teak into its own class of high-return forest investments which I will call precious woods. There are other limited supply species such as Mahogany and Tasmanian Blackwood that could, like teak, be grown on plantations. However very few investment opportunities exist in the market place for species other than teak. These other opportunities need to be considered with due diligence because they are normally with very small companies.

The second category of timber investment purposes is structural timber. These are species grown for basic construction purposes. Species such as Radiata pine, Loblolly pine, and Douglas fir are the most common timberland species. Most of these species are grown in temperate areas in the United States, Canada, and New Zealand.

The final category for timberland investment is fiber woods, which are usually fast growing species such as Eucalyptus. These woods are typically used for pulp and paper. Fiber woods have traditionally been the largest sector for timber land investment, since short rotations can be justified and a return on capital realized sooner than with structural timber or precious woods.

The most direct way to get timberland into your portfolio is to purchase it outright. There are many plantations for sale around the world that could be managed professionally on your behalf. However, the cost and overhead of direct ownership of timberland is simply too onerous for most individual investors.

Another approach is to invest directly into one or more companies operating in niche timber markets. A good example is Panama Teak & Forestry, a company that holds and manages teak and timber properties in Panama. You may also consider New Zealand companies such as Forest Enterprises or Roger Dickie which allow you to participate in some of the best growing softwood timberlands in the world.

The most liquid investment option available is investing in publicly traded stocks that hold significant timberlands. These include Plum Creek Timber REIT (NYSE:PCL), Rayonier (NYSE:RYN), Sino Forest (TOR:TRE) and TimberWest Forest Corp. (TOR:TWF.UN). Although this type of investment offers high liquidity your return will probably be significantly less with these publicly traded timber stocks than it would be with an equivalent investment in a privately held timber company.

Timberland has proven to be one of the best performing commodity investments available to both institutional and individual investors because it combines several unique characteristics. These include biological growth, the ability to schedule harvest to maximize profit and land ownership to enhance reward versus risk considerations. In addition to being an excellent portfolio diversifier and inflation hedge, timberland has traditionally offered returns for the long-term investor that equal or surpasses those in other asset classes.

Grant Glessing, RPF obtained his diploma in forestry from BCIT in 1986 and his Forest Management degree from Oregon State University in 1989. Grant has worked in the British Columbia forest industry for the past 20 years. He is currently working for Tolko Industries Ltd. as a Regional Forester responsible for 160,000 hectares of plantations in the Cariboo region of British Columbia. Grant also has extensive experience with international timber investments in both Panama and New Zealand. He is currently a director of Panama Teak Forestry.